Aim of this information

This information forms part of our series on insurance and sets out your legal obligations around the disclosure of convictions when taking out an insurance policy.

Why is this important?

According to government figures, over 12.5 million people in the UK have a criminal record. Whilst most people are aware of what they’ll need to disclose when applying for a job, some will be less certain when buying insurance, especially when an insurer doesn’t ask clear and concise questions.

Under the Rehabilitation of Offenders Act, ‘spent’ convictions do not have to be disclosed to an insurer, irrespective of what questions are asked. Knowing what you legally need to disclose will ensure you’re adequately insured and, should you need to make one, any claims are covered by your policy.

What do I need to disclose?

The Rehabilitation of Offenders Act 1974 (ROA)

Under the ROA, all criminal convictions have a ‘rehabilitation period’ based upon the sentence or disposal an individual is given in court. Once this rehabilitation period comes to an end, a conviction is considered ‘spent’ and doesn’t need to be disclosed when purchasing any type of insurance policy.

Whilst a conviction is unspent, you are legally required to disclose it to an insurer if they ask.

The Association of British Insurers (ABI) good practice guide advises insurers to:

“Ask clear and concise questions during the application process and do not ask questions which either misrepresent or imply an obligation to disclose convictions which should not be disclosed. This will better enable consumers to provide details of their unspent convictions so that tailored decisions can be made.”

An example of a clear and concise question would be:

“Do you have any unspent convictions?” Yes/No

However, from time to time we will see insurers ask questions such as:

“Do you have any criminal convictions?” or “Have you ever received a criminal conviction?”

In terms of insurance, the broad effect of the ROA is to allow somebody with a spent conviction to ‘legally lie’ to any question which, if answered truthfully, would disclose a spent conviction. The question above should therefore be interpreted as “Do you have any unspent convictions?”

How do I know whether my convictions are spent?

The ROA is complicated and it can be difficult to know what you need to disclose. However, there are a number of ways to work out whether a convictions is spent. You can:

- Use our online Disclosure Calculator.

- Obtain a basic disclosure from the Disclosure and Barring Service. This costs £21.50 and only discloses unspent convictions.

- Work it out for yourself – To help you with this you can obtain a copy of your police record (often referred to as a Subject Access Request). This is free of charge and provides all information that is held on the Police National Computer (PNC) about you, not just unspent convictions. It doesn’t identify which convictions are spent and which are unspent.

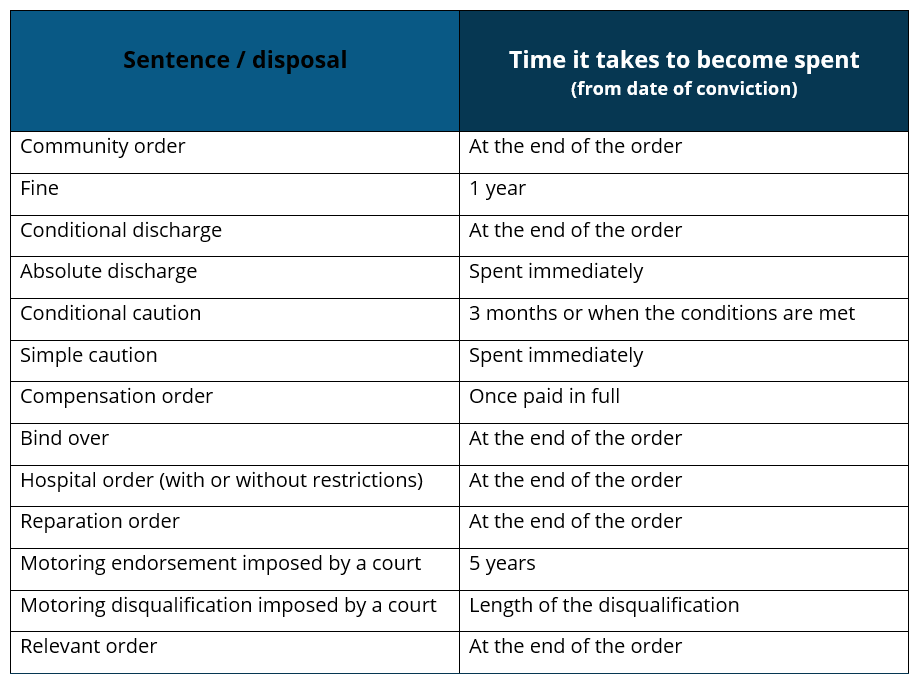

The tables below set out the rehabilitation periods for a range of sentences/disposals.

Adult prison sentences

Other adult disposals

Further information on the ROA can be found here.

Fixed Penalty Notices for driving offences

The ROA does not cover Fixed Penalty Notices (FPN).

Fixed penalty notices are on-the-spot fines issues by the police for minor offences. If you receive a FPN and pay it within the specified time limit, all liability for the offence is discharged and the offence doesn’t form part of your criminal record. If however, you fail to pay a FPN you’re likely to receive a court summons. If you accept responsibility for the offence, whether in person at court or by post, or are found guilty, you will have a conviction which will (in most cases) form part of your criminal record.

If you receive an FPN for an endorseable motoring offence this will result in an endorsement on your licence. It will stay on your licence for either 4 or 11 years. It will take 5 years (for an adult) to become spent. In practice, this means that you will need to disclose it to a motor insurer until it becomes spent. You can find further information on Motoring convictions and the Rehabilitation of Offenders Act.

When do I need to disclose and what will happen when I do?

It’s important to remember that you only need disclose the details of an unspent conviction if an insurer ask you to. There’s no need to volunteer the information.

When you take out a policy

The majority of insurers will ask you to disclose any unspent convictions when you request a quote. If you fail to answer the questions fully and accurately this could invalidate your policy and result in non-payment of any future claims. It could potentially lead to prosecution and another conviction.

Once you’ve disclosed, there are a number of possible responses an insurer might have, depending on their approach to convictions.

The insurer may:

- Not be able to offer you a quote. This doesn’t mean you’ve been ‘refused’ insurance. It simply means you don’t fit within their underwriting guidelines. For example, if an insurer who specialises in insurance for the over 50’s chooses not to offer a quote to a 25 year old, that person has not been refused insurance.

- Offer you insurance at a higher premium because they believe you pose a higher risk. If the premium is more than you are happy (or able) to pay you should shop around. Not all insurers assess risk in the same way.

- Impose special terms such as a higher excess or include more exclusions or limitations in your policy.

During a policy

If you receive a conviction during your current policy, check your insurers approach to ‘mid-term changes’. Insurers have a duty to inform you within your policy documents of any obligations you have to disclose a change in circumstances. Unless there is an explicit condition in your policy, you do not have to disclose a new conviction until your next renewal.

If you are required to notify, the insurer may:

- Cancel your insurance immediately.

- Cancel your insurance but offer you a short ‘grace’ period during which you can arrange insurance somewhere else.

- Continue your insurance but advise you they won’t offer you another policy at renewal.

- Increase your premium because they believe the risk has increased.

- Impose special terms such as a higher excess or a more restrictive policy.

If mid-term changes don’t need to be notified, you can continue with your policy until it need to be renewed. At renewal, you can either update your existing insurer or look elsewhere.

If your conviction becomes spent during the term of your policy, you won’t need to disclose it at your next renewal. Whether your insurer will reduce your premiums mid-contract will depend on their policy.

When you make a claim

Insurance companies normally rely on the information given by the policyholder at the start of the policy. However, when a significant claim is made, insurance companies will investigate the circumstances which could include obtaining a copy of your criminal record.

Although insurers have access to various databases, they are not currently able to obtain an official copy of your criminal record. Therefore, as part of the claims process, you may be asked to provide details of your criminal record (including a basic DBS certificate). This is to ensure it matches with the information you gave when you took out the policy.

It’s important that you provide any information the insurer requests. If you refuse it’s possible the insurer will refuse to pay any claim that has been made. However, this should only apply to convictions that were unspent at the time you took out the policy (or the latest renewal).

If the insurer becomes aware of an unspent conviction which you hadn’t previously disclosed they may:

- Avoid the policy. If you policy is ‘avoided’ it is as if it never existed. This means that your claim will not be paid. You should receive back any premiums you have paid to the insurer. However, the insurer may seek to recover any previous claims made under the policy.

- Refuse the claim. Insurers would usually also cancel the policy under these circumstances.

- Reduce payment. If the insurer would have insured you despite the conviction, but at a higher premium, they may reduce their pay out proportionately. For example, if your premium would have doubled, you may only be entitled to half the total claim value.

What could happen if I do not disclose when asked?

When you’re getting quotes

- Probably nothing. At quote stage insurers rely on the information you give them because it would be too expensive to verify everything you say.

- However, it’s important to remember that if you don’t disclose when asked, you may not actually have insurance cover and any future claims may be refused.

During a policy

- Probably nothing. During your policy insurers will rely on you to make them aware of any important changes. They don’t usually check that you have done so.

- However, it’s possible that your insurer may find out about your conviction by another means e.g. an anonymous phone call o newspaper report. This could result in the avoidance or cancellation of your policy or an increase in premium.

When you make a claim

- You will normally be asked to confirm whether the details you gave when you took out the policy are correct. If you are unwilling or unable to provide this evidence, the insurer is unlikely to pay the claim and may cancel your policy.

- If the insurer becomes aware that you had an unspent conviction when you took out the policy which you didn’t disclose when asked, they could avoid your policy, refuse the claim, reduce any payouts and you may be prosecuted.

How can an insurer find out about my criminal record?

Insurers do not have access to police records and they’re unable to do a criminal record check without your consent.

Generally, when you take out a policy an insurer will rely on what you tell them. Occasionally, they may ask you to provide proof of certain aspects (for example your no claims bonus), but this rarely relates to criminal records. In theory, an insurer could ask you to provide proof of your unspent conviction (with a basic DBS certificate). However, insurers may use other methods to check what information you’ve provided them with (for example doing an internet search).

It’s more likely that your insurer will take more interest in your criminal record when you make a claim. At this point, insurers normally check the details you have previously given them. If this is different to what you’ve told them when you took out the policy, they may investigate further. If the claim is quite big, they might do an internet search against your name to see if that flags anything.

Regardless of whether an insurer is carrying out an investigation or routinely checking a certain percentage of claims they receive, you need to be clear about how an insurer might find out about your criminal record.

In the past, insurers often used ‘subject access requests’ to get proof of your criminal record. This practice was make illegal in March 2015 (enforced subject access) and you have the legal right to refuse to give your consent to this.

Insurers can ask you to provide proof of your unspent convictions. They should normally do this by asking you to obtain a basic DBS certificate. The cost is £21.50 – you should check whether your insurer will cover this. They might expect you to pay as part of ‘cooperating with the claims process’.

How can convictions affect a claim?

When you make a claim on your insurance, your insurer will undergo a claims validation process. They will either go through the details of your policy over the telephone, or send a representative to your home. You will usually be asked to confirm that the information you gave regarding previous convictions is accurate.

If you have disclosed correctly

If you answered the questions relating to convictions correctly when you took out the policy) or at the appropriate renewal stage), your claim should proceed as normal.

It may be that, because of the conviction, your insurer decides to look into your claim in greater detail. Although this is frustrating, you must be seen to be cooperating with your insurer. The presence of a conviction on a policy should have no bearing on whether the claim is paid out, so long as it was properly disclosed when the policy was taken out (or at the appropriate renewal stage).

If you were not asked

If you were not asked about convictions, any unspent convictions you had when you took out the policy cannot be used by the insurer as a reason for not paying out.

If the insurer claims to have asked you about convictions, they would need to provide evidence that a clear and specific question was asked when you took out the policy (or when you last renewed).

If you have not disclosed correctly

If you didn’t answer the questions relating to convictions correctly when first taking out the policy (or at the appropriate renewal stage), your insurance company may seek to ‘avoid the policy’ and not pay out.

What if my insurer refuses to pay a claim due to non-disclosure or misrepresentation?

What is non-disclosure and misrepresentation?

‘Non-disclosure’ is when you fail to disclose a material fact when applying for, or renewing insurance. An example would be if you did not disclose an unspent conviction.

A related term, ‘misrepresentation’ is when you make an incorrect statement. An example would be if you stated that you had a conviction for theft, when it was actually a conviction for fraud or stated that you had been given a community sentence, when you were actually given a prison sentence.

What does it mean if my insurer is ‘avoiding’ my policy?

If a non-disclosure (or misrepresentation) has led to an insurer providing cover where it otherwise would not have done so, the insurer can legally ‘avoid’ the policy. This means they treat the policy as though it never existed. The insurer will not have to pay out on any claim made under the policy. Unless fraud is involved, the insurer will normally return any premiums you have paid.

What if I disclosed to an intermediary when buying my insurance?

Many people don’t buy their insurance directly from the insurer. Instead they use an ‘intermediary’, for example an insurance broker, financial advisor or bank.

Intermediaries are often seen as acting on your behalf because they are seeking the best cover for you from a wide range of insurers. This makes it difficult to argue that the insurance company should have been aware of the details you gave the intermediary. You may have to pursue a separate complaint against the intermediary or consider a claim against them in the civil court.

However, if your intermediary had an arrangement to recommend your insurer, they can be seen as acting on behalf of the insurer. In this case, it is difficult for the insurance company to claim that information you gave to the intermediary wasn’t properly disclosed.

Answering questions about refusals, cancellations and special terms

Understanding the terms

‘Refused’ insurance does not have an agreed definition within the insurance industry. You should ask the insurer for clarification of what they mean when they use this term. If an insurer has simply chosen not to insure you because they do not offer cover to people with convictions, you have not been ‘refused’. This is the same as someone who is 25 seeking insurance with an insurer that only insures people over 50.

‘Cancelled’ insurance is when an insurer cancels your contract of insurance during the term of your policy, typically due to the disclosure of an additional material fact that wasn’t disclosed when you took out the policy. This does not include where they inform you that they will not be offering cover following your next renewal date.

‘Special terms’ may be imposed by an insurer in order to reduce a perceived risk. This is when you are offered insurance but not on the standard terms they would normally offer. For example, they may add exclusions that would avoid them having to pay a claim in certain circumstances, such as in the event of a theft, fire or a particular circumstance such as damage caused by vigilantism.

Answering the question

If you have a spent conviction, you do not normally need to disclose anything that would lead to the disclosure of that conviction. The ROA states that:

“A conviction which has become spent or any circumstances ancillary thereto …shall not be a proper ground for prejudicing him in any way …”

Therefore, if you have only experienced a refusal or cancellation as a result of a conviction that is now spent, you could respond by saying “no”.

If you have an unspent conviction, you have to answer any question put to you fully and honestly. Therefore, if you have had insurance refused, cancelled or special terms imposed due to the conviction you must inform the insurer. If other insurers have simply declined to offer you a quote due to your conviction you do not have to state that you have been refused insurance. But, if you have had insurance cancelled as a result of not disclosing a conviction which should have been disclosed, this will need to be disclosed to future insurers.

How can I make a complaint about my insurer?

The Association of British Insurers (ABI) has previously published statements of practice stating that:

- Insurers should ask clear questions about facts they considered material.

- In deciding whether to avoid a policy, insurers should rely only on the answers given or withheld.

- Insurers should only avoid policies where the non-disclosure or misrepresentation was deliberate or reckless, not where it was innocent.

- Customers are required to answer questions only to the best of their knowledge and belief.

If you disagree with a decision made by your insurer, you should make a formal complaint to them, giving them the opportunity to rectify the problem.

If you remain unhappy after your insurer has reviewed your case, you can raise a concern with the Financial Ombudsman Service (FOS). The FOS is able to take account of both the law and good industry practice which can often result in a much fairer outcome for the customer.

Where can I get insurance?

The attitudes of insurers towards convictions vary enormously and many mainstream insurers operate a blanket policy of not providing insurance to people with unspent convictions.

Unlock has a comprehensive list of specialist insurance brokers which is available to download here. It provides a list of insurance brokers that provide various types of insurance cover to people with unspent convictions. Insurance brokers try to find the best cover for your needs from amongst their own panel of underwriters. All the brokers on our list are regulated by the FCA.

Please note, there may still be some particular situations where it continues to be difficult to find an insurance policy. This may be because of the type of policy you’re looking for (for example commercial insurance) or the type of offence you were convicted of (for example a fraud or sexual offence).

The ability of an insurer to cover you may depend on:

- How long you have been a policy holder (if you have been with an insurer for a number of years, and have a good claims history, they may still be willing to continue cover).

- The type of conviction (certain convictions may be considered irrelevant).

- The length of time since the conviction.

When purchasing a policy, we advise that in addition to comparing prices, you research the companies to see what other customers’ experiences are of the insurers. This will allow you to make an informed choice.

Unlock also publishes a list of motor insurers which contains details of mainstream motor insurers that do not ask (or ask specific questions) about non-motoring convictions.

Is insurance more expensive if you have an unspent conviction?

This is a very common question but there is no simple answer. Disclosure of an unspent conviction currently results in most insurers refusing to offer a quote and you will therefore have significantly less choice. It also means that standard ‘mass market’ policies, which may be cheap, are not available to you. As a result, it’s not unusual to be faced with more expensive insurance when you have a conviction.

However, securing insurance through a broker can have price advantages. People who have stayed with the same insurance company for years may find their premiums have steadily risen. Asking a broker to secure the best price for you may result in premiums reducing, even with a conviction.

The cost of insurance varies according to many factors and each insurer has a different approach. You may find that other factors (e.g your postcode or what you are trying to insure) are more influential than your conviction. However, it remains the case that many people experience a significant increase in the cost of insurance when disclosing an unspent conviction.

Frequently asked questions

-

You only have to answer the questions you are asked. Normally, if asked about convictions, the question will relate to all individuals who are covered by the policy. Therefore, in the example of a household policy, the unspent convictions of anybody normally living at the property would need to be disclosed.

-

If you’re not asked, you don’t have to disclose. However, although insurers are meant to ask clear and specific questions, it’s always best to check any assumptions as well as the terms and conditions of cover and your policy documents. There is sometimes a question about the disclose of unspent convictions in the policy small print.

-

You only need to disclose convictions in the last 5 years. If you have an unspent conviction that was obtained more than 5 years ago but isn’t yet spent, you do not have to disclose it.

-

Spent convictions can sometimes stay on your driving licence long after they become spent.

Even though an endorsement may stay on your licence for longer than the ‘spent’ period (for example drink driving endorsements stay on for 11 years), legally you still do not need to disclose it to motor insurers once it’s spent.

Comments

Add Comment