Last month, the Financial Conduct Authority published an occasional paper on access to financial services. I fed into this work, particularly focusing on the issues people with convictions face in accessing insurance. So it was good to see the authors include an especially challenging section of the report focused at a lack of buy-in to industry guidance.

There was heavy reference to the work that Unlock has done with the Association of British Insurers (ABI), including developing good practice, but highlighted how:

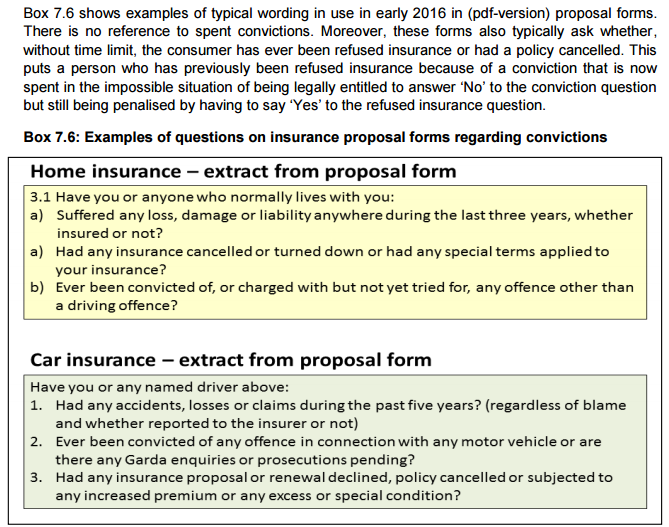

“it is still commonplace for proposal forms to have questions such as “have you ever been convicted””

The ABI guidance states that it is good practice to refer only to ‘unspent’ convictions, so clearly insurers are not doing this.

Although it didn’t name the companies involved, the FCA paper included two anonymous examples of current questions by home insurers and motor insurers.

The poor wording of questions by insurers is a major problem. Unlock’s helpline regularly gets contacted by people using insurance websites and asking us for clarity about what they do and don’t need to disclose. Very often, this is because the insurance company hasn’t made it clear that they don’t need to disclose convictions that are now spent under the Rehabilitation of Offenders Act 1974.

This is something we’re looking at. We’ve had one our helpline advisors do some research into the questions asked by insurers, and we’re in the process of pulling this together and analysing the findings.

As an aside, it was good to see a number of other issues featured in the occasional paper, including:

- The numbers of people affected – In the infographic that the FCA used, they said that 750,000 people with unspent convictions and their families can struggle. This comes from a figure we presented a couple of years ago, and this is a conservative estimate of the numbers with unspent convictions. Although this figure is an underestimate for another reason – it doesn’t include those that are potentially covered by some of the misleading questions that insurers ask (see below). When this is taken into account, the numbers affected by the practice of insurers runs into the millions, given there’s over 10.5 million people in the UK with a criminal record.

- The lack of insurance products for people with unspent convictions

- How people with convictions can be good customers

More information

- You can find out more about the FCA occasional paper.

- There are details of our policy work on fair access to insurance and dealing with misleading questions.

- For practical self-help information on insurance, visit the information section on our website.

- There is practical guidance for insurers

Comments

Add Comment